Grow Your Wealth!

Invest in Multifamily Properties

in only the

Best Markets & Neighborhoods

Get Data You Cannot Find Anywhere Else!

find Emerging

Markets

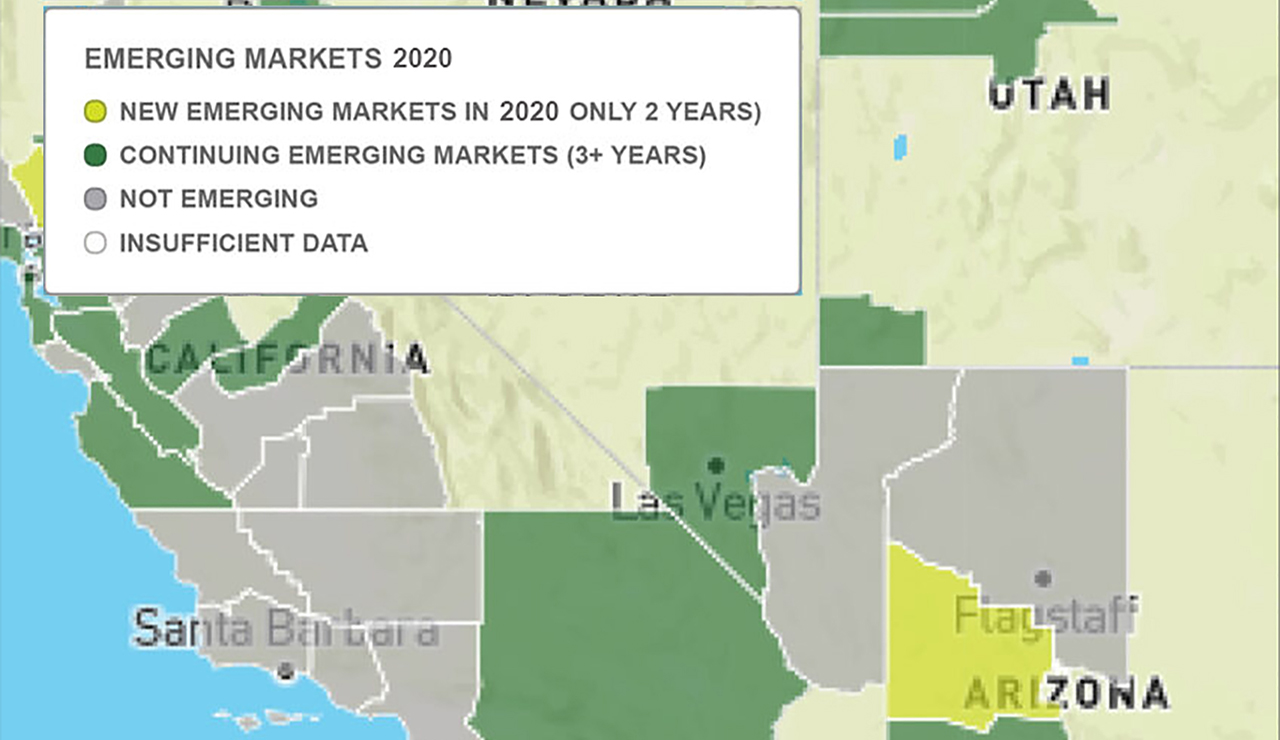

Escalate Your Appreciation by Investing in Emerging Markets abcd

Choosing the right market to invest in is critical. Markets that are emerging produce higher profits–more cash flow from faster-rising rents, and more equity from faster-increasing property values. REIndicator tracks the Emerging Markets and keeps you up-to-date on a Quarterly basis! Be among the more savvy investors–get ahead by investing in the higher-growth markets.

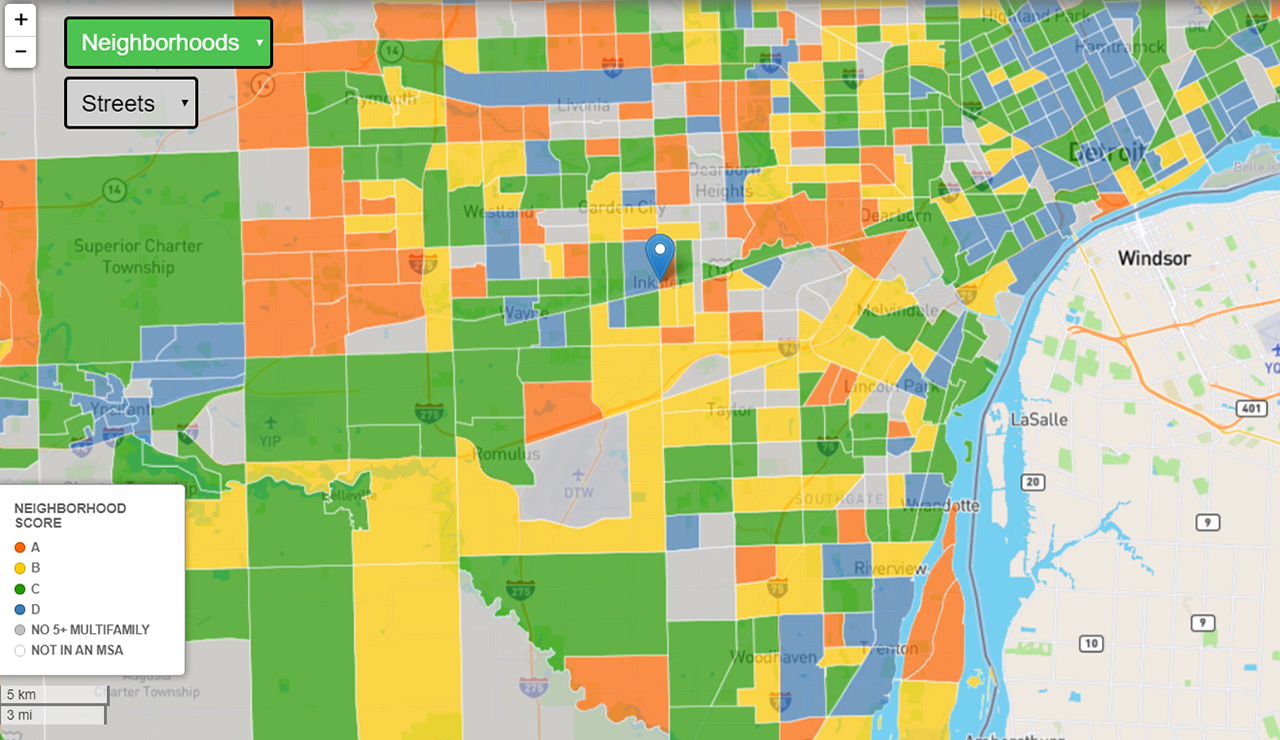

Know the neighborhood scores

What’s Next Door Has a Controlling Influence on your Success

You absolutely must select your neighborhood with the same care that you put into selecting your property. When you buy a property, you are also buying into a neighborhood. Your investment is either reinforced by its neighbors–or undermined by them. What’s happening nearby can dramatically affect your property’s appreciation. With REIndicator’s A/B/C/D scale, you see the pattern of neighborhood reinvestments that can guide your decisions with a data-driven understanding. With real estate, it’s location, location, location! Be among the most informed investors and accelerate your profits and growth.

reveal the

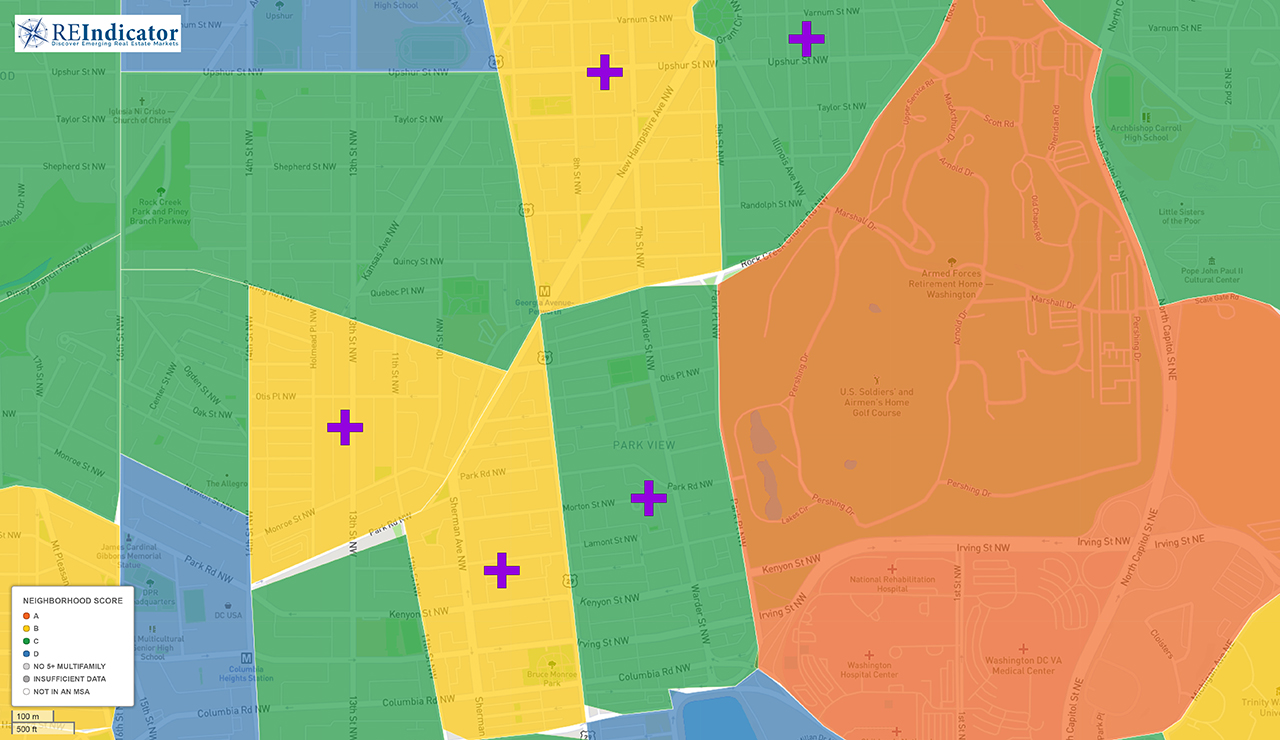

emerging Neighborhoods

Go the Extra Mile: Invest in the Fastest Growing Neighborhoods abcd

Just like with markets, some neighborhoods are growing faster than others. Some areas attract more investments, and are referred to as ‘Paths of Progress.’ Be among the elite investors that take advantage of this advanced tool which can get you ahead faster by investing in this exclusive group of neighborhoods that can build wealth even faster.

Markets tracked

Micro-Neighborhoods™

Opportunity Zones

Paper cuts saved

Grow Your Multifamily Investments

See the trends in your current & prospective marketsSNAPSHOTS

See Your Markets

Emerging Markets – Know which markets are currently growing the fastest — with quarterly updates!

MicroNeighborhood™ Classifications -Know the letter grade (A, B, C, D) of each and every neighborhood with multifamily properties in each of the metropolitan areas across the country; this invaluable information cannot be found anywhere else!

Satellite Views – Add the details of the land uses across all of the neighborhoods to get more context of the MicroNeigborhood™ Classifications

Fed Beige Book – Learn the latest economic trends at the regional level as analyzed by the Federal Reserve economists from around the country

ZIP Codes – See the boundaries for every ZIP Code, a common way deals are sorted by brokers

County Boundaries – Larger–and even medium-sized Metro areas can get complicated so these boundaries help keep you oriented AND can be vital to understanding property taxes and valuations

ANALYZER

Understand Your Markets

Emerging Markets – Know which markets are currently growing the fastest — with quarterly updates!

MicroNeighborhood™ Classifications – Know the letter grade (A, B, C, D) of each and every neighborhood with multifamily properties in each of the metropolitan areas across the country; this invaluable information cannot be found anywhere else!

Satellite Views – Add the details of the land uses across all of the neighborhoods to get more context of the MicroNeighborhood™ Classifications

Fed Beige Book, with Archive – Discover the latest–and track the recent history of–economic trends at the regional level as analyzed by the Federal Reserve economists from around the country

ZIP Codes – See the boundaries for every ZIP Code, a common way deals are sorted by brokers

County Boundaries – Larger–and even medium-sized Metro areas can get complicated so these boundaries help keep you oriented AND can be vital to understanding property taxes and valuations.

Markets Population Growth – Better understand how the markets compare to each other with these size rankings

Markets Size Categories – Each market is classified as Primary, Secondary, Tertiary and Quaternary based on population and economic activity measures to further help you in selecting the market that’s right for you

Recession Recovery Rate – Know how well each and every one of the 429 Markets is doing in regaining the jobs lost in the Recession of 2020–and how each ranks compared to the others — updated monthly!

Multifamily Directory – Know the locations of the other multifamily properties to select better rental and sales comps; available in a select–and growing–list of the larger markets

Opportunity Zones – See–with just the click of a button–the locations of the neighborhoods where properties can cost far less to operate (and produce considerably more cash flow) when they qualify for a capital gains waiver.

ANTICIPATOR

Get Ahead of the Curve

Emerging Markets – Know which markets are currently growing the fastest — with quarterly updates!

MicroNeighborhood™ Classifications – Know the letter grade (A, B, C, D) of each and every neighborhood with multifamily properties in each of the metropolitan areas across the country; this invaluable information cannot be found anywhere else!

Satellite Views – Add the details of the land uses across all of the neighborhoods to get more context of the MicroNeighborhood™ Classifications

Fed Beige Book, with Archive – Discover the latest–and track the recent history of–economic trends at the regional level as analyzed by the Federal Reserve economists from around the country

ZIP Codes – See the boundaries for every ZIP Code, a common way deals are sorted by brokers

County Boundaries – Larger–and even medium-sized Metro areas can get complicated so these boundaries help keep you oriented AND can be vital to understanding property taxes and valuations.

Markets Population Growth – Better understand how the markets compare to each other with these size rankings

Markets Size Categories – Each market is classified as Primary, Secondary, Tertiary and Quaternary based on population and economic activity measures to further help you in selecting the market that’s right for you

Recession Recovery Rate – Know how well each and every one of the 429 Markets is doing in regaining the jobs lost in the Recession of 2020–and how each ranks compared to the others — updated monthly!

Multifamily Directory – Know the locations of the other multifamily properties to select better rental and sales comps; available in a select–and growing–list of the larger markets

Opportunity Zones – See–with just the click of a button–the locations of the neighborhoods where properties can cost far less to operate (and produce considerably more cash flow) when they qualify for a capital gains waiver.

Emerging Markets Time Series – See the history–going back almost 3 decades!–of all the Emerging Markets across the USA to get better sense of the up and down cycles for each market and the country as a whole

Strong Recovery Markets – Take advantage of a study conducted by our demographer that reveals the markets that have the best track record during the economic recoveries of the last 20 years

Markets Jobs Charts – See the jobs growth and decline–matched against national recessions–over nearly 3 decades, and get a sense of how each market compares to the overall US

Emerging MicroNeighborhoods™ – Another game-changer from REIndicator! Find which neighborhoods in each market are changing the fastest and may have more upside potential; an indispensible feature you cannot find anywhere else!